Understanding Forex Trading Regulations: A Guide for Traders

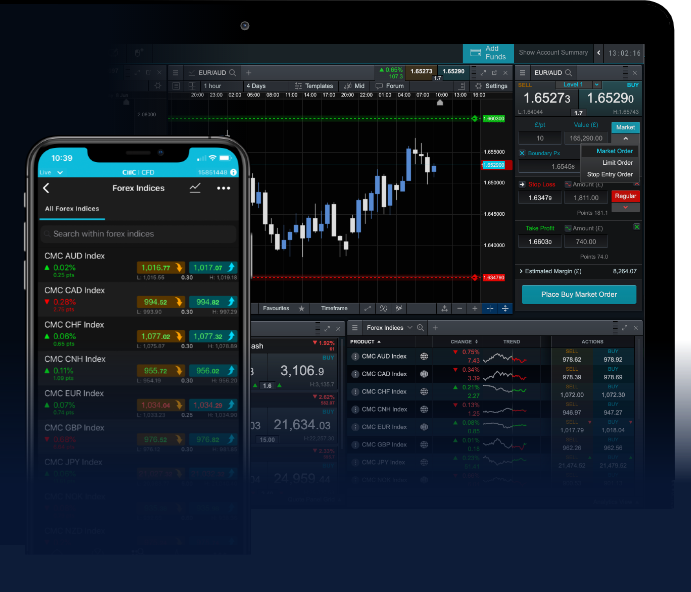

Forex trading is one of the most dynamic markets worldwide, attracting both novice and professional traders looking to capitalize on currency fluctuations. However, the landscape of forex trading is heavily influenced by regulations that vary by country. Understanding these regulations is crucial for anyone looking to enter the forex market, as they help safeguard traders from fraud, ensure fair practices, and promote market stability. In this article, we will delve into the essential forex trading regulations and their implications for traders. Furthermore, we will discuss the utilization of forex trading regulations Forex Trading Apps that comply with these regulations, ensuring a safe trading environment.

The Importance of Forex Trading Regulations

Forex trading regulations are established by governmental and financial authorities around the world. Their primary goals include protecting consumers, maintaining the integrity of the financial system, and preventing financial crimes such as money laundering and fraud. By enforcing these regulations, authorities help create a level playing field for all market participants.

Key Regulatory Agencies

Several key regulatory agencies oversee forex trading in various regions. Here’s a look at some of the most influential ones:

- Commodity Futures Trading Commission (CFTC) – USA: The CFTC regulates futures and options markets to protect traders against fraud and abusive practices.

- National Futures Association (NFA) – USA: The NFA is a self-regulatory organization that oversees forex brokers and ensures compliance with CFTC regulations.

- Financial Conduct Authority (FCA) – UK: The FCA regulates financial markets in the UK, including forex brokers, to ensure fair practices and protect consumers.

- European Securities and Markets Authority (ESMA) – EU: ESMA sets guidelines for member states in the European Union regarding financial regulations, including those affecting forex trading.

- Australian Securities and Investments Commission (ASIC) – Australia: ASIC regulates forex trading in Australia and enforces rules designed to protect traders.

Types of Forex Trading Regulations

Forex trading regulations can be broadly categorized into several types:

Licensing and Registration

Forex brokers must obtain licenses from regulatory bodies to operate legally. This process typically involves demonstrating financial integrity, professional competence, and adherence to consumer protection standards.

Capital Requirements

Regulatory agencies impose minimum capital requirements that forex brokers must maintain. This ensures that brokers have sufficient funds to manage trading activities and operate responsibly.

Leverage Limits

Leverage allows traders to control large positions with relatively small capital. However, high leverage can also lead to significant losses. Regulatory agencies often set limits on leverage to protect investors. For example, the FCA has capped leverage for retail clients at 30:1.

Reporting and Transparency

Forex brokers are required to maintain transparency with their clients. They must provide clear information about trading conditions, fees, and risks involved. Regular reporting to regulatory agencies is also essential to ensure compliance with established norms.

Anti-Money Laundering (AML) Regulations

AML regulations mandate that forex brokers implement measures to prevent money laundering activities. This could include Know Your Customer (KYC) procedures, which ensure that brokers verify the identities of their clients.

Global Differences in Forex Regulations

Although many countries have established regulatory frameworks for forex trading, the specifics can vary significantly. For instance:

- In the U.S., strict regulations are in place to protect traders, which can limit the trading options available.

- In contrast, some offshore jurisdictions may have more relaxed regulations, offering higher leverage but posing greater risks.

- European regulations tend to be stringent, particularly concerning investor protection and transparency.

Choosing a Regulated Forex Broker

Selecting a regulated forex broker is essential for mitigating risks in your trading journey. Here are some tips for choosing a reputable broker:

- Verify the broker’s regulatory status by checking with relevant authority websites.

- Read reviews and testimonials from other traders to assess the broker’s reputation.

- Look for transparency in fees, spreads, and trading conditions.

- Ensure that the broker offers robust customer support options.

Conclusion

Forex trading regulations play a vital role in shaping the forex market. They help create a safe and fair environment for traders, protecting them from pitfalls while promoting market integrity. By understanding these regulations and choosing a regulated broker, traders can navigate the forex market with greater confidence. With advancements in technology, forex trading apps provide additional tools and resources to facilitate trading in compliance with regulations, further enhancing the trading experience. Always stay informed about the regulatory landscape to ensure a successful trading journey.