Understanding PrimeXBT Commission Rates: A Comprehensive Guide

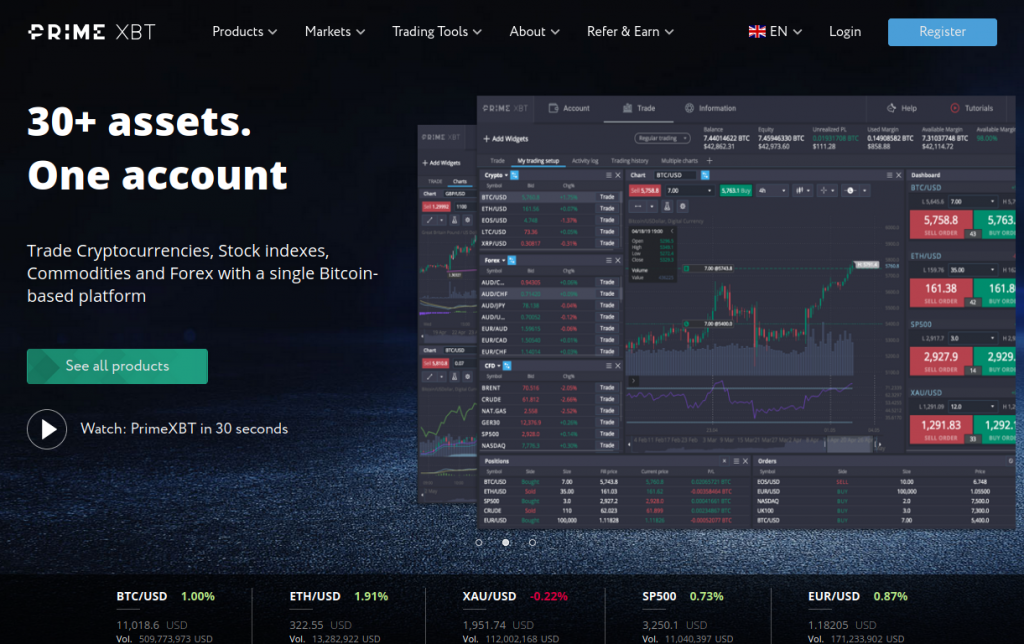

In the evolving world of cryptocurrency trading, understanding commission rates is vital for optimizing your trading strategy. PrimeXBT is a popular trading platform that has gained attention for its competitive rates and wide range of offerings. In this article, we will delve into the specifics of PrimeXBT commission rates, how they compare to other platforms, and practical tips for traders. Additionally, we will touch on primexbt comission rate PrimeXBT and Pocket Option to provide further insight into trading options available.

What are PrimeXBT Commission Rates?

PrimeXBT operates on a commission-based model, which means traders pay a fee for each transaction they execute. This fee structure can vary based on several factors, including the type of asset traded, the volume of trades, and whether the trader is opening or closing a position. Understanding these commission rates is essential for maximizing profitability, as they can significantly impact net gains or losses.

Types of Fees on PrimeXBT

On PrimeXBT, traders encounter several types of fees that fall under commission rates:

- Trading Fees: For each buy or sell order executed, traders incur trading fees. These fees are typically expressed as a percentage of the total transaction value.

- Withdrawal Fees: When moving funds off the platform, users may face withdrawal fees, which vary depending on the cryptocurrency being transferred.

- Inactivity Fees: If accounts remain dormant for extended periods, PrimeXBT may charge inactivity fees.

Commission Rate Structure

PrimeXBT provides traders with a transparent fee structure. The platform uses a tiered commission model, which means that fees can decrease based on the volume of trading activity.

For instance, high-frequency traders may enjoy reduced commission rates, allowing them to save on fees in the long run. This model encourages active trading on the platform, benefiting both the users and the exchange.

Comparison with Other Platforms

To better understand the value of PrimeXBT’s commission rates, it is helpful to compare them with those of other trading platforms. For example, popular exchanges like Binance and Coinbase have their specific fee structures.

– **Binance** offers varying trading fees depending on trading volume and whether the user holds Binance Coin (BNB), which can reduce fees further.

– **Coinbase**, on the other hand, typically has higher fees due to its user-friendly interface and additional services.

In comparison, PrimeXBT’s tiered volume-based system can be more advantageous for active traders who prioritize low fees over an extensive range of services.

How to Minimize Your Commission Costs on PrimeXBT

Savvy traders often seek ways to minimize commission costs. Here are some effective strategies:

- Increase Trading Volume: Engaging in a higher volume of trades can place traders in higher tiers of the fee structure, effectively lowering commission percentages.

- Use Limit Orders: Placing limit orders can sometimes result in lower trading fees compared to market orders.

- Stay Informed: Regularly reviewing PrimeXBT’s announcement section for updates on fee changes and promotions can help traders stay ahead of potential cost increases.

Benefits of PrimeXBT’s Commission Rate Model

One of the significant advantages of PrimeXBT’s commission structure is its transparency. Traders can easily calculate how fees will impact their overall costs, which aids in making informed trading decisions. Furthermore, the competitive rates, especially for high-volume trades, attract both novice and experienced traders.

Conclusion

Understanding the commission rates on PrimeXBT is fundamental for anyone looking to engage in cryptocurrency trading. By familiarizing yourself with the associated fees and leveraging their tiered structure, you can maximize your profitability. Additionally, comparing these rates to other platforms allows traders to make informed decisions when choosing where to trade. Whether you’re a seasoned trader or just starting your journey, knowing how to navigate commission rates can significantly impact your overall success in the crypto market.