Understanding Escrow and Arbitration Frameworks for Secure Transactions

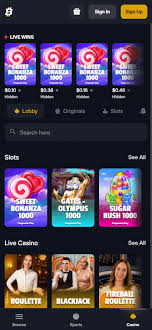

The digital landscape of financial transactions is continually evolving, leading to the need for robust mechanisms that ensure security and trustworthiness. In this context, Escrow & Arbitration Frameworks for Disputed Bets Bitfortune app has emerged as a critical platform that integrates the functionalities of escrow and arbitration frameworks. These frameworks not only protect buyers and sellers in transactions but also provide a structured process for resolution in case of disputes. This article delves into the principles, processes, and benefits of escrow and arbitration frameworks, shedding light on their importance in securing digital transactions.

What is Escrow?

Escrow is a financial arrangement whereby a third party holds and regulates the payment of the funds required for two parties involved in a given transaction. It serves as a neutral intermediary, ensuring that the transaction proceeds smoothly and protecting both the buyer’s and seller’s interests. In an escrow arrangement, the buyer deposits the funds with the escrow agent, who holds these funds until the seller fulfills their obligations, typically by delivering goods or services.

The Role of Escrow in Transactions

Escrow provides several critical advantages in transactions:

- Security: By holding funds in trust, escrow protects against the risk of fraud or non-delivery.

- Trust: Escrow builds trust between parties, especially when dealing with unfamiliar individuals or entities.

- Obligation fulfillment: The involvement of an escrow agent ensures that both parties fulfill their obligations before the transaction is completed.

How Escrow Works

The process typically involves the following steps:

- The buyer and seller agree on the terms of the transaction and select an escrow agent.

- The buyer deposits funds into the escrow account managed by the agent.

- Once the escrow agent confirms the deposit, the seller is notified to deliver the goods or services.

- Upon successful delivery, the buyer approves the transaction, and the escrow agent releases the funds to the seller.

- If issues arise, the escrow agent may work with both parties to resolve disputes, sometimes involving arbitration.

Understanding Arbitration

Arbitration is a dispute resolution process where an independent third party, known as an arbitrator, helps settle disagreements between two parties. Unlike traditional court litigation, arbitration is usually a faster and less formal process. The decisions made by an arbitrator are typically binding and enforceable, making this process a popular choice in commercial disputes.

The Importance of Arbitration in Digital Transactions

As the e-commerce sector expands, the potential for disputes increases, necessitating effective resolution mechanisms:

- Efficiency: Arbitration typically resolves issues more quickly than court proceedings.

- Expertise: Parties can choose arbitrators with specific expertise related to their dispute.

- Confidentiality: Unlike court cases, which are public, arbitration hearings are usually private.

Arbitration Process

The arbitration process generally unfolds in the following stages:

- Filing a Notice of Dispute: One party submits a notice, outlining the nature of the dispute.

- Selection of Arbitrator(s): Both parties agree on an arbitrator or panel of arbitrators.

- Hearing: A formal hearing takes place where both parties present evidence and arguments.

- Decision: The arbitrator issues a decision known as an ‘award,’ which can include monetary compensation or other relief.

Combining Escrow and Arbitration Frameworks

The integration of escrow and arbitration provides a comprehensive solution for securing transactions in various sectors, especially in online markets. Vendors can assure customers regarding the safety of their investments through escrow while having a clear route for resolution via arbitration in case disputes arise. This dual mechanism enhances security by ensuring that both parties adhere to the terms of the agreement, fostering trust and promoting smoother transactions.

Benefits of Using Escrow and Arbitration Frameworks Together

Employing both frameworks provides several advantages:

- Complete Protection: Buyers are assured that their funds are secured until they receive the expected goods or services.

- Structured Resolution Process: Disputes are managed through a streamlined arbitration process, minimizing disruptions to business.

- Legitimacy: Involvement of neutral third parties in both escrow and arbitration enhances the credibility of the transaction.

Challenges and Considerations

While escrow and arbitration frameworks present significant benefits, there are also challenges that users need to be aware of:

- Costs: Fees associated with escrow services and arbitration can sometimes be a deterrent for smaller transactions.

- Complexity: Understanding and navigating the terms of escrow agreements and arbitration rules can be complex for some users.

- Limited Jurisdiction: Arbitrations may be limited by jurisdictional issues, especially in international transactions.

Conclusion

As online transactions continue to proliferate, the need for secure and trustworthy methods to protect both buyers and sellers remains paramount. Escrow and arbitration frameworks serve as invaluable mechanisms that not only facilitate secure transactions but also ensure efficient dispute resolution. By incorporating both systems, users can significantly mitigate risks and enhance their confidence in the digital marketplace.